It’s sunny in Texas — at least at the usual times.

Residential markets in the major cities are returning to seasonal patterns after years of unusual ups and downs, though it takes some squinting into the sun to recognize.

Texan brokers, builders and buyers alike were forced to adapt to plenty of shake-ups in 2024, not limited to brokerage retrenchment following the National Association of Realtors antitrust settlement, pervasive home affordability challenges, shifts in ultra-luxury and lower-end markets and a constant hope that lower mortgage rates are coming soon.

Yet many brokers expect a return to seasonal market demand in the Lone Star state, and the data seems to back them up, despite lingering headwinds from the oddball couple of years.

“Texas is the bright spot — the area I love to speak about,” said NAR’s Director of Real Estate Research Nadia Evangelou. “The housing market in Texas is characterized by strong demand, very robust construction activity and very good performance across major metro areas.

The real estate market swelled to some of its highest highs in the years since 2020. By the third quarter in 2024, median home prices in Dallas, for one, were up 45 percent from the first quarter in 2020. Brokers in Texas metros banked on a massive surge of in-migration into Austin, Houston and Dallas, spurred by an enviable post-pandemic recovery thanks to relative affordability, a business-friendly environment and abundant job opportunities in a diverse range of high-paying sectors. The three cities couldn’t hold onto more than two months of inventory of homes at a time through 2022.

The following year, 2023, home sales declined nearly 11 percent across the state, while median prices essentially flatlined, but then a heated spring market in 2024 seemed to be the sign that pent-up demand was beginning to be released. 2024 was going to be the year, until it wasn’t.

Home prices and sales volume last year showed little to no significant movement, with median home prices hovering at about $335,000 from October 2023 to October 2024, coinciding with elevated inflation, mortgage rates and a factor less present last year: political uncertainty.

“Buyers and sellers were maybe just in a wait-and-see mode for a while, and that’s why we softened — we’re still on track to finish the year, well, sort of flat, about like last year,” Daniel Oney, director of research at Texas A&M University’s Texas Real Estate Research Center, said in December.

Now, the theory goes, 2025 will be the year. Reality has sunk in, and brokers and brokerages adjusted. All that running-in-place may even have set brokers up for a 2025 market where they may get to sprint again, especially if buyers and sellers also give up on the idea that mortgage rates will get low again.

New home pipeline

In Texas, when there’s demand for homes, homebuilders can build supply fast — unlike in states with more stringent zoning and approval processes.

So when existing home sales dropped, new home sales jumped.

For the first time in over a decade, in August both new and existing home supply converged at about 4.4 months of inventory, Oney said. Nationally, there were 4.1 months of inventory for existing homes and 7.9 months for new homes in August, according to data provided by NAR.

“When we sit around the table brainstorming what might happen, [geopolitical issues] are unknowns, but we’d expect something pretty extraordinary to really damage the housing market in Texas.”

To many, the convergence of inventory levels for new and existing homes across the state suggests a healthy equilibrium headed into 2025, as demand for new homes helps balance the existing inventory, giving buyers more options, preventing inventory bottlenecks and alleviating the supply variable in the affordability equation. (This is not a sure thing: in mid-December, publicly traded homebuilders saw stocks drop for days on worries about levels of home starts and frequency of 2025’s Federal Reserve Board interest rate reductions.)

There were a few reasons why this happened — but namely, builders got savvier, with well-timed, aggressive borrowing options for new homes amid heightened unaffordability and high mortgage rates. In addition to a surge in mortgage rate buy-downs, more developers began taking out forward commitments on blocks of discounted borrowed funds for several homes at a time in their developments, often from their own internal mortgage companies, according to Austin Real Estate Experts owner Matt Menard. This let builders offer lower mortgage rates on new homes, some at just 4 or 5 percent, while concession caps hindered resellers from doing likewise.

Resellers couldn’t compete.

“How do we pitch these older homes?” a realtor from the Four Rivers Association, between Austin and San Antonio, asked Oney at an event in August, decrying the “shiny, new subdivisions” making older homes in New Braundels and San Marcos a harder sell.

However, Dallas and Houston issued the most additional single-family building permits in the nation compared to their historical averages at roughly 36 and 40 percent more, respectively, Evangelou said.

To listing agents competing with these new homes — and looking to prove their value — Oney suggested pointing potential buyers to helpful facts, like how older homes are more likely to provide better access to jobs and good schools.

Agents get smart

As an agent, proving your value to clients in 2024 was the key to the job. NAR’s policy changes in September, prompted by an antitrust verdict, raised the bar for negotiation, especially as resellers struggled to compete with new homes offering better rates and attractive locations.

With a quarter of all realtors only getting their start in the last four years, according to NAR, many of Texas’ large brokerages — some in anticipation of a real estate boom in the early months of 2025 — decided it was time to trim the ranks.

“If agents aren’t producing, then they don’t need to work here,” Century 21 Judge Fite owner Jim Fite said in October.

Century 21 Judge Fite, the fourth largest brokerage in Dallas by headcount and once celebrated for its new-agent training, slimmed its roster. It wasn’t the only one. Brokerages tightened screening processes, focused on agents who prioritize relationships over leads and sidestepped the negative aura of downsizing by saying they were cleaning house ahead of a busy season. If their predictions pan out, it’ll leave a more balanced, leaner market, where fewer agents meet demand without oversaturation.

High and low

Agents at the top of the market benefitted from a huge surge in the luxury and ultra-luxury market in 2024, and they could continue to do so this year.

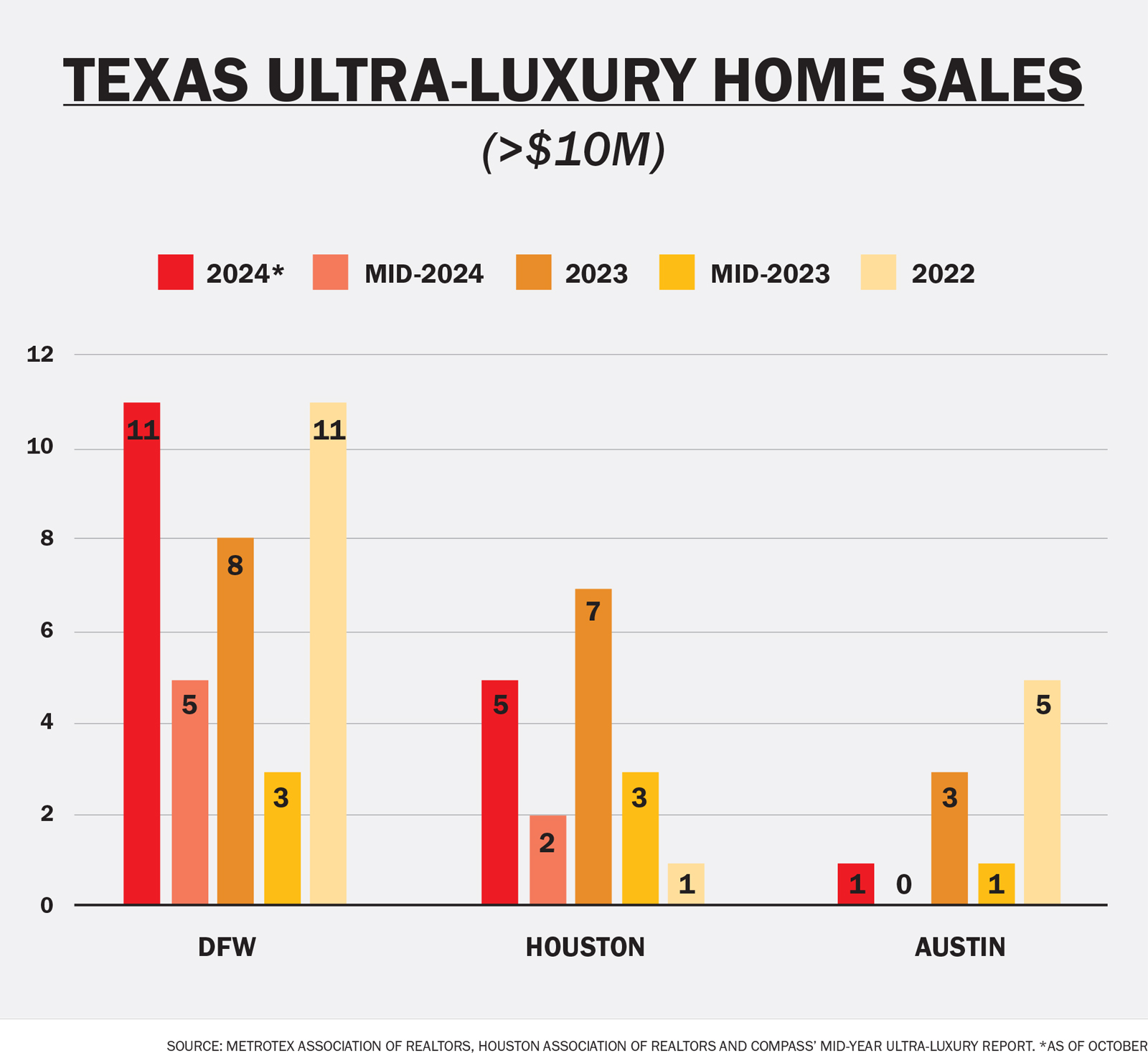

Dallas solidified its dominance in the Texas ultra-luxury market, where cash buyers were shielded from high mortgage rates. By September, 11 homes priced over $10 million sold in Dallas-Fort Worth, compared to four in Houston and one in Austin, when only eight sold in Dallas during all of 2023. High net worth newcomers helped support a diversified market, attracting further investment in infrastructure and services, high-earning brokers said.

First-time and move-up home buyers alike benefited slightly from reduced constraints on lower-priced homes, too, with better balanced inventory across price points — but affordability challenges continue to squeeze buyers out of the $250,000 or less range, Evangelou said.

Data couldn’t be retrieved on Texas sales for specific price tiers, but NAR’s data for the southern U.S., which Envangelou said was commensurate, show that Texas’ part in real estate’s shared affordability problem — while year-over-year sales for homes priced over $1 million climbed an average of nearly 20 percent each month by October — year-over-year sales for homes under $100,000 dropped an average of almost 16 percent each month in the same period, and homes between $100,000 and $250,000 about 10 percent each month. Sales for homes over $1 million declined year-over-year each month of 2023 until July but haven’t seen negative year-over-year changes once since.

Affordability could be relieved in Texas’ upcoming legislative session, when lawmakers are likely to consider bills reducing property taxes as well as possibly easing regulations for office-to-residential conversions, Oney said. Still, in any case, industry leaders say strong demand and balanced inventory put Texas in the right position to outperform in 2025, despite external unknowns.

“We’re not as concerned about a downturn in 2025,” Oney said. “When we sit around the table brainstorming what might happen, [geopolitical issues] are unknowns, but we’d expect something pretty extraordinary to really damage the housing market in Texas.”