-

A $100 property credit for eligible purchases, such as minibar purchases, dining, spa treatments or bike rentals (varies by property).

-

Room upgrades, when available.

-

Daily breakfast for two (FHR only).

-

Early check-in and late checkout.

-

Double-earning opportunities. You can earn Membership Rewards points on your eligible card and hotel points from select hotel loyalty programs at the same time.

-

Terms apply.

But these perks aren’t necessarily “free.” Booking through FHR and THC often costs more than booking directly with the hotel — sometimes substantially more.

We found that booking FHR and THC properties through AmEx was, on average, 6.3% more expensive than booking direct, costing an average of $68 more for a two-night stay.

This means that, on average, you’d need to get $68 worth of value from the extra perks to justify booking through FHR and THC rather than booking directly. But perks like the $100 property credit you’d get through AmEx might offset the extra cost completely.

Booking through AmEx’s FHR/THC is usually more expensive

According to NerdWallet’s analysis:

Booking through FHR and THC was more expensive than booking direct 70% of the time — but the extra perks can make it worthwhile. FHR/THC was cheaper 27% of the time, and the same price for the remaining cases. If you’re able to book a stay through FHR or THC at the same price or less than booking direct, you’d essentially be getting extra perks without any additional cost.

Among the 83 hotels where booking through FHR and THC was more expensive, the average price difference was $116. Among the 31 hotels where booking through FHR and THC was cheaper, the average savings was $86.

On average, a two-night stay was $68 more when booked through FHR or THC than when booked direct. More specifically, across the two programs:

Since FHR bookings come with a daily breakfast for two — and THC bookings don’t — those extra benefits alone could make up for the higher average cost.

Among the hotels reviewed, Accor and Marriott properties were the most expensive to book through FHR and THC, compared with booking direct. Of the five Accor hotels reviewed, rates were $152 higher than booking direct, on average. Accor’s portfolio includes high-end brands like Fairmont Hotels & Resorts and Banyan Tree.

Of the 31 Marriott properties reviewed, rates were an average of $137 higher. On the more expensive side, booking a stay at The Ritz-Carlton, Dallas, a Marriott property, through FHR, was nearly 19% pricier than booking direct in one case — amounting to a difference of more than $350 for a two-night stay. Even with the breakfast, full use of the credits and a room upgrade, it might be hard to justify that markup.

Hotels unaffiliated with major loyalty programs were only $5 more expensive, on average, to book through FHR or THC than to book direct, making it much easier to come out ahead in benefits. This includes hotels that were either affiliated with smaller loyalty programs, or unaffiliated with any programs.

|

Loyalty program |

Number of hotels in study |

Average extra cost when booking through FHR/THC (vs. direct) |

|---|---|---|

|

Accor Live Limitless |

5 |

+$152 |

|

Marriott Bonvoy |

31 |

+$137 |

|

Hilton Honors |

11 |

+$80 |

|

IHG Rewards |

13 |

+$49 |

|

World of Hyatt |

18 |

+$65 |

|

Other |

39 |

+$5 |

|

Total |

117 |

+$68 |

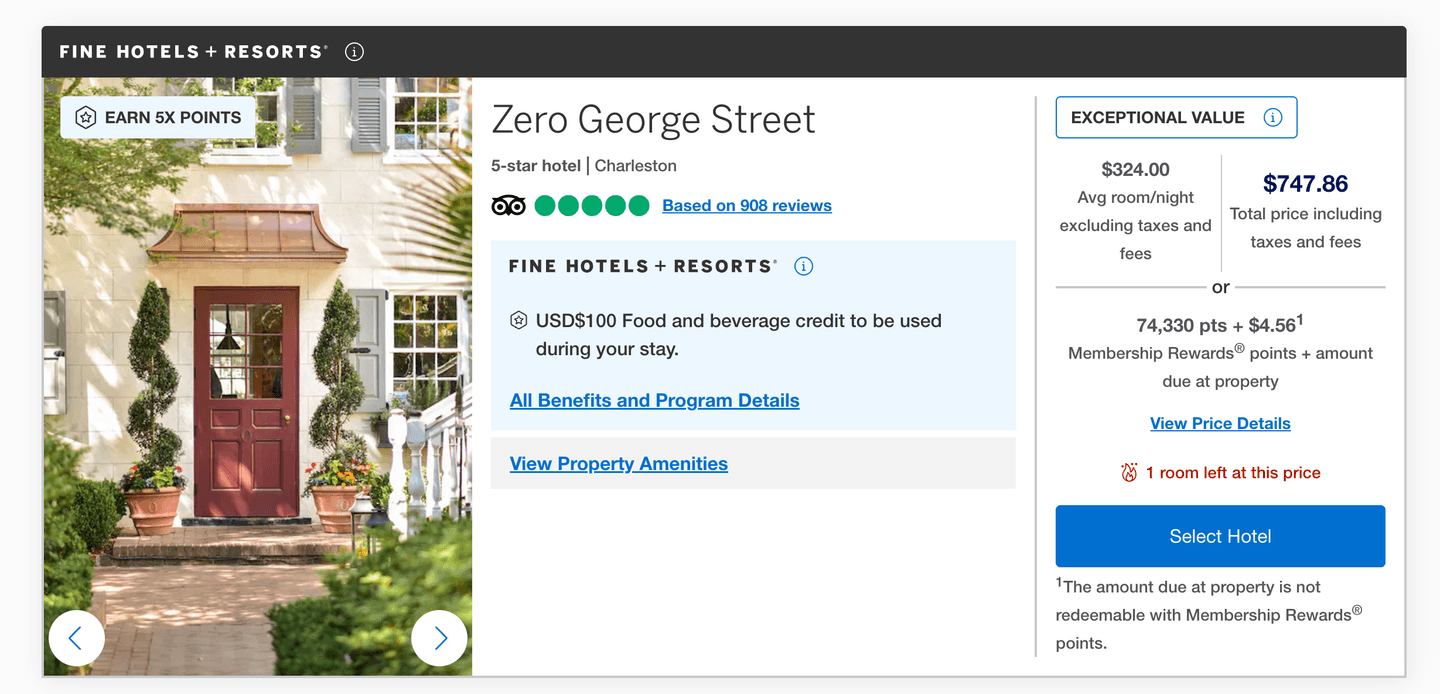

For great deals, look for the ‘Exceptional Value’ badge. Some hotels on FHR and THC have an “Exceptional Value” badge in their listings. A spokesperson for American Express said that means the hotel has signed an agreement with American Express to offer its lowest rates.

Many small, boutique hotels that don’t have their own loyalty programs with special member rates offer their best available rates to AmEx customers through FHR and THC. For properties like Zero George, in downtown Charleston, South Carolina — which has the “Exceptional Value” badge — offering favorable rates and add-on benefits through FHR is a good way to attract business.

“We’re very much a leisure-luxury property, which aligns perfectly with people who want to spend their AmEx points,” says Adrian Goffinet, a finance and operations manager at the property. “Those are high-spending guests who are going to dine at our Michelin-selected restaurant.”

It’s less common to see these badges on properties from major hotel chains, which typically offer lower rates to members who book directly through their own sites and enroll in their loyalty programs.

How much are FHR and THC benefits worth?

Assuming you only use the property credits and nothing else, you might value FHR and THC benefits at a conservative $100 per stay. That means booking direct could be a better option if the direct price is, well, more than $100 cheaper.

But you might be willing to pay a higher price if:

-

You have the American Express Platinum Card®— or another eligible card — and you’re trying to redeem a use-it-or-lose-it coupon-style credit for these programs. American Express Platinum Card® cardholders get up to $300 semiannual credits toward eligible stays (up to $600 per year) when they prepay with their card. Terms apply.

-

You’re willing to splurge for extra perks. Booking through FHR and THC gets you some benefits that resemble elite status perks — no actual elite status required. For some, that might justify a higher cost.

FHR is the more luxurious of the two collections. Booking through FHR gets you:

-

Daily breakfast for two (AmEx values this at $60 per room, per day, though it may depend how much you value that plate of eggs).

-

$100 credit to spend on eligible charges, which vary by hotel but can include spa treatments, dining or other on-property activities.

-

Room upgrade, when available.

-

Early check-in at noon and guaranteed late checkout at 4 p.m.

-

Complimentary Wi-Fi — which, frankly, should be free at all hotels these days anyway.

AmEx says these perks are worth $550 on average, but their actual value varies widely. For example, the cost of a room upgrade could be $50 at some properties or $300 at others. You might blow your $100 credit on overpriced minibar food just to use it, even though you could buy the same items elsewhere for much less.

If you’d be willing to pay for room upgrades and hotel food, though, those perks could be valuable.

THC properties are typically upscale, though not as lavish as FHR hotels. These properties require a two-night minimum stay to take advantage of THC benefits, which include:

-

Early check-in at noon, when available.

-

Room upgrade upon arrival, when available.

-

$100 credit toward eligible on-property expenses like dining or spa services.

-

Late checkout, when available.

AmEx puts the value of THC perks at $150 on average. But they only kick in if you book a stay of two nights or more. And, of course, actual value may vary based on whether a room upgrade or early/late checkout is actually available — or if you’d actually use that $100 credit anyway.

Should you book through FHR and THC?

The short answer: Do your own price comparisons. FHR and THC rates are sometimes cheaper and sometimes more expensive, but prices rarely match. And cost isn’t the only factor.

Book direct if you prefer flexibility or worry about adding a middleman. Booking through FHR and THC adds another layer if you need to change or cancel your reservation.

And speaking of changes, they may be difficult (or impossible) to make. To qualify for the $300 semiannual credit from the American Express Platinum Card®, your stay must be prepaid. Terms apply. Generally, prepaid stays are nonrefundable, meaning you can’t get your money back if you decide to cancel.

Book through FHR and THC if you value the elite perks. If you do — and the price difference is under $100 — then upgrades, late checkout and property credits can easily offset the cost. For example, if you’d spend $100 at the hotel restaurant anyway, and the AmEx rate is only $50 more, you’re effectively ahead by $50 due to the property credit. And if the FHR/THC rate is the same or lower — which might be the case for properties that have an “Exceptional Value” badge — you’re effectively getting extra perks for no charge.

🤓 Nerdy Tip

You can also sometimes find deals unique to FHR and THC. For example, it’s common to find third-night-free deals (but NerdWallet’s study only considered two-night stays). And even if you’re booking with a big hotel loyalty program, American Express offers another key benefit: The ability to double-dip on points earning. When booking hotels through American Express, you can earn both American Express Membership Rewards points and points from hotel loyalty program (e.g., Hilton Honors or Marriott Bonvoy points). That’s often not the case when booking through other online travel agencies, such as Expedia.

Don’t forget the $300 semiannual hotel credits on the American Express Platinum Card®: Since the semiannual $300 credits are use-it-or-lose-it, paying a bit more through AmEx might make sense if you’d otherwise forfeit the credit — as long as you’re not spending more than the credit’s $300 value to do it. Terms apply.