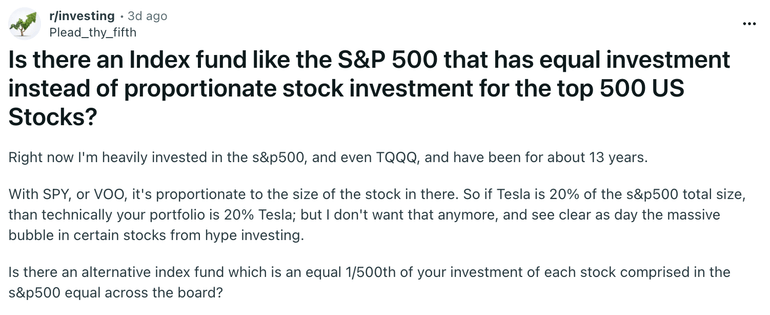

Back in the summer, we wrote in our email newsletter, The Nerdy Investor, about how a handful of stocks dominate the S&P 500 — and how NVIDIA in particular dominates the index. (You can read that issue here.) Now, Reddit seems to be taking note…

To answer plead_thy_fifth’s question: there are indeed a number of exchange-traded funds like this. They’re called equal-weight S&P 500 ETFs, and we’re looking at their pros and cons below.

Side note: Plead_thy_fifth refers to a “massive bubble” in their post, and they’re not alone in that theory. Even OpenAI CEO Sam Altman has speculated that we may be in an AI bubble. I discussed this in a recent episode of NerdWallet’s Smart Money Podcast. The Nerdy Investor took a more in-depth look at the AI bubble theory in our December issue (you can read that here).

Two equal-weight S&P 500 ETFs and their fees and returns

At the time of writing, there are two non-leveraged equal weight S&P 500 ETFs on the market. They’re listed below. Data is sourced from VettaFi, Google Finance and fund websites, is current as of market close Dec. 2, 2025, and is intended for informational purposes only.

-

The Invesco S&P 500 Equal Weight ETF (RSP) has an expense ratio of 0.20%, and is up 8.77% year-to-date. Its average dividend yield over the last 30 days is 1.63%.

-

The Invesco S&P 500 Equal Weight Income Advantage ETF (RSPA) has an expense ratio of 0.29%, and is up 1.48% year-to-date. It sells options on its holdings to generate additional income. Its average dividend yield over the last 30 days is 9.05%.

Pros and cons of equal-weight S&P 500 ETFs

-

Con: Higher fees and lower returns. The Vanguard S&P 500 ETF (VOO), the largest S&P 500 ETF by assets under management, has an expense ratio of 0.03% and is up 16.58% year-to-date. Those are considerably lower fees and higher returns than either of the equal-weighted funds listed above.

-

Pro: Potentially more protection against a tech bubble. The top 7 stocks in VOO, all of which are large-cap tech stocks, make up about one third of the ETF’s holdings, despite it being an S&P 500 ETF. In the equal-weight funds listed above, however, each stock accounts for roughly the same fraction of a percent of the ETF’s holdings. If something bad happens to Big Tech in the years ahead — say, if it turns out that the AI boom is overhyped — an equal-weight ETF may not fall as much as a market-cap-weight S&P 500 ETF like VOO.

-

Pro: Higher dividend yields. VOO’s average yield over the last 30 days is 1.10%, which is lower than the equal-weight funds listed above. Many of the big tech stocks that dominate regular S&P 500 ETFs like VOO do not pay dividends, so equal-weight ETFs may be better for income investors.

Advertisement

|

NerdWallet rating

4.8 /5 |

NerdWallet rating

4.5 /5 |

NerdWallet rating

5.0 /5 |

|

Fees $0 per online equity trade |

Fees $0 per trade. Other fees apply. |

Fees $0 per trade for online U.S. stocks and ETFs |

|

Promotion None no promotion available at this time |

Promotion Get up to $1,000 when you open and fund an E*TRADE brokerage account. Terms apply. |

Promotion None no promotion available at this time |

Other equal-weight index funds

There are also equal-weight ETFs on other indexes besides the S&P 500.

-

The largest equal-weight Dow Jones Industrial Average ETF by assets under management is the First Trust Dow 30 Equal Weight ETF (EDOW). It has an expense ratio of 0.50%, a year-to-date return of 13.62%, and an average dividend yield over the last 30 days of 1.41%.

-

The largest equal-weight Nasdaq 100 ETF by assets is the First Trust Nasdaq 100 Equal Weighted Index Fund (QQEW). It has an expense ratio of 0.55%, a year-to-date return of 14.24%, and an average 30-day yield of 0.44%.

The bottom line on equal-weight S&P 500 ETFs

If you’re concerned that your index funds are too concentrated in Big Tech, equal-weight S&P 500 ETFs are a potential solution that could see less volatility in the event that the biggest tech stocks start to underperform. They also generally pay higher dividends than typical S&P 500 ETFs.

But if Big Tech doesn’t take a tumble, equal-weight S&P 500 ETFs may continue to lag behind their market cap-weight counterparts in terms of returns — especially after their fees, which tend to be higher than typical index funds.

More on index fund investing

The author owned shares of the Vanguard S&P 500 ETF at the time of publication.