Rialto Capital has brokered a peace deal with at least one borrower.

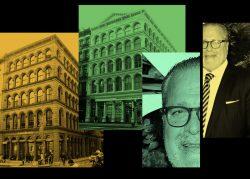

The lender provided the Chetrits with a three-year loan extension on two Soho properties, The Real Deal has learned. The developer fell behind on payments on the $76.5 million loan backed by 459 Broadway and 427 Broadway during the pandemic in 2021, according to Trepp.

But Michael Chetrit of Chetrit Organization inked a deal with Rialto to extend the loan and bring the loan out of special servicing. The Chetrits had to chip in new equity to close the deal.

Will Forbes of Iron Hound Management negotiated the deal.

The two five-story office and retail buildings struggled with vacancies. When the loan was originated in 2014, both buildings were fully leased. But the property at 427 Broadway lost a key tenant when American Apparel filed for bankruptcy in 2017 and closed its 13,000-square-foot store.

The buildings reached full occupancy in 2019. But the pandemic reduced occupancy to 33 percent, according to MorningStar. The loan’s debt service coverage ratio slipped to below 1, meaning revenue could not meet its monthly debt payments.

Chetrit was able to bring in new tenants — by late 2023, occupancy rose to 100 percent. But a year later, the properties landed back in special servicing.

Commercial mortgage-backed securities have to go through the special servicing process in order to be worked out. This process can take years. In the case with the Soho properties, Chetrit had to chip in new equity.

“The Chetrit Organization is grateful for [Rialto’s] creativeness and willingness to work with us to come to an amicable resolution,” said Michael Chetrit in a statement. “We look forward to closing a few more restructurings in the coming week.”

Chetrit Organization was led by the late Jacob Chetrit and his brother Juda, but it appears that Jacob’s son Michael Chetrit is now the point person for the firm since Jacob died in January.

Chetrit Organization often partners with the better-known Chetrit Group, led by Joseph and Meyer Chetrit. Chetrit Organization has faced a few notable foreclosures, including its 366,000-square-foot FiDI office tower at 1 Whitehall.

But Michael Chetrit’s comments suggest the borrower could be resolving some of these problem loans in the near future.

Rialto acquired a chunk of the former Signature Bank’s loan portfolio in 2023. Since then, it has not shied away from launching foreclosures against borrowers, which has angered many borrowers who thought they signed on for loans with the customer-friendly Signature Bank.

Rialto has claimed it only enforces its rights and remedies in “rare instances.”

Read more

Chetrit’s $77M Soho loan heads to special servicing, despite full occupancy

Chetrit Group falls behind on Soho portfolio mortgage