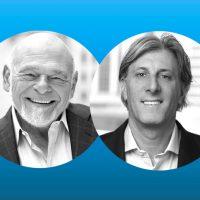

Equity Commonwealth notched a $50.2 million impairment loss after offloading office holdings in Austin amid its corporate wind-down following the death of founder Sam Zell last year.

The Chicago-based REIT, led by David Helfand, sold two Austin-area office properties for $64.5 million, or about $105 per square foot, the Austin Business Journal reported. The properties, totaling 616,000 square feet, were acquired by Marbella Interests, a local property management firm and the family office of oil-and-gas entrepreneur Bryan Sheffield.

JLL brokered the sale, which included three office buildings: Bridgepoint Square, a two-building office complex spanning 27.7 acres at 6200 and 6300 Bridge Point Parkway, and the 20-story East Ninth Street in downtown Austin.

Bridgepoint Square,built in the 1980s and ’90s, was acquired by Equity Commonwealth in 2022 and is appraised for tax purposes at $86.8 million. Capitol Tower is appraised at $76.8 million and is 69.4 percent leased.

Equity Commonwealth is liquidating its assets after calls from investors to return capital to shareholders. The firm had been looking for a megadeal to deploy its warchest for years before Zell died at age 81 in May of last year.

The firm had nearly $2.2 billion in cash on hand at the end of March, regulatory filings show. The Austin portfolio was among the last of its office holdings. It also has a buyer for an office building in Washington, D.C., according to earlier reports. That leaves one property — 17th Street Plaza, at 1225 17th Street in Denver, which spans 709,000 square feet.

Other notable office transactions in Austin this year include Endeavor’s April purchase of Plaza on the Lake, which spans 120,800 square feet about six miles northwest of downtown Austin. E-commerce firm Sock Club bought the 190,600-square-foot Twin Towers office building, at 1106 Clayton Lane, from Omninet Capital in August.

—Andrew Terrell

Read more

Sam Zell’s firm lists two Austin office buildings amid liquidation

Sam Zell’s former firm to close after investors call for liquidation

Sam Zell’s office REIT won’t commit to a specific coronavirus strategy just yet