Title insurers Riverside Abstract and Madison Title are facing a bigger problem with Fannie Mae than they have let on, according to a memo from the agency obtained by The Real Deal.

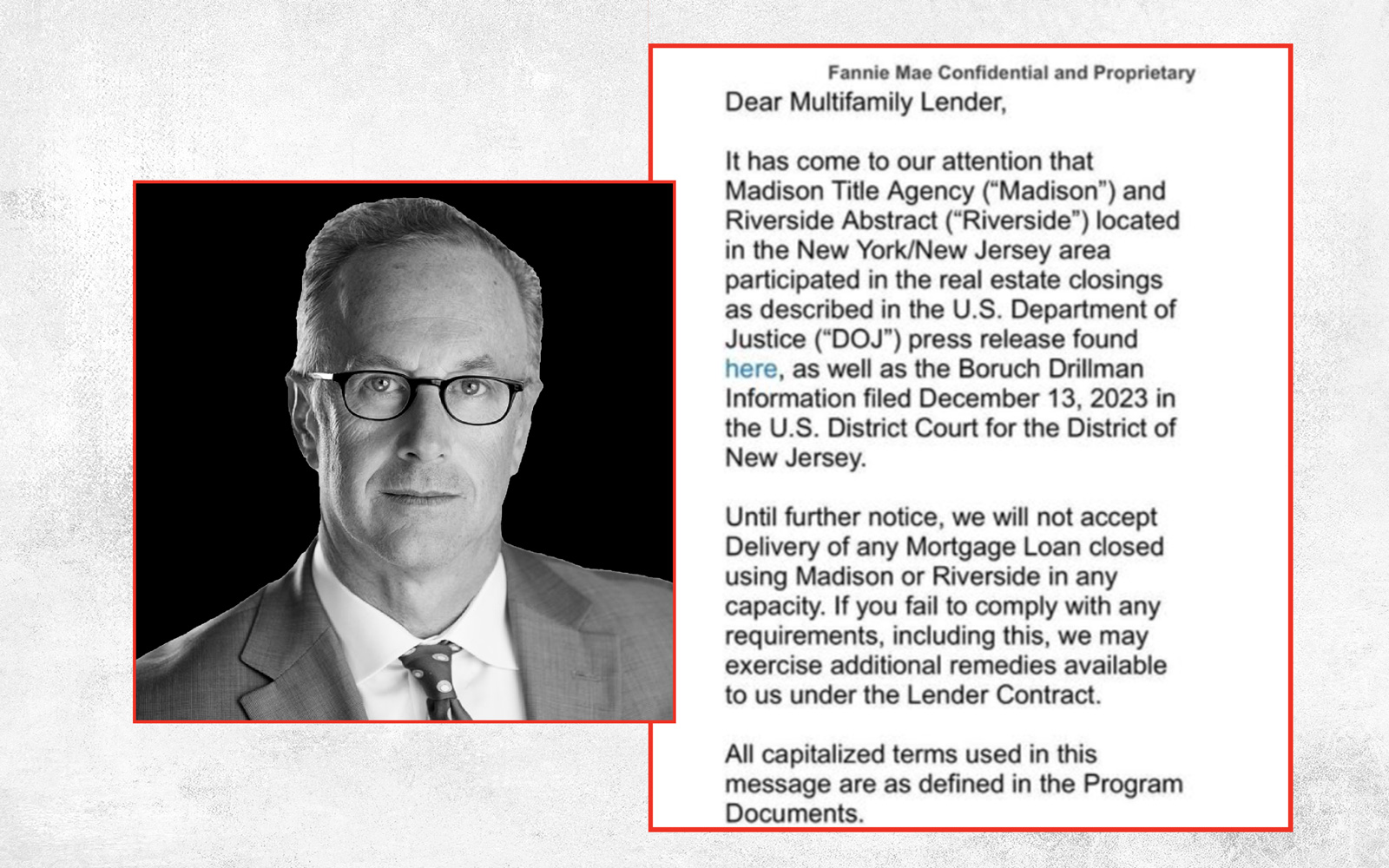

“Until further notice, we will not accept delivery of any mortgage loan closed using Madison or Riverside in any capacity,” Fannie Mae deputy general counsel Jeff Goodman wrote to lenders.

The reason, he wrote, is that New Jersey-based Riverside and Madison participated in real estate closings orchestrated by Boruch Drillman that were deemed fraudulent by the Department of Justice.

About two weeks ago, a lawyer’s email surfaced that said some servicers and sellers had stopped doing business with the two title insurers. Both companies scrambled to do damage control. Last week, Riverside told its employees that it had reached an agreement to sell the company because of false rumors that it was barred from serving as a title or escrow agent for Fannie Mae and Freddie Mac loans.

But Goodman’s memo appears to indicate that the rumors were true. His message warns lenders that if they “fail to comply with any requirements, including this,” Fannie Mae could seek remedies under its contract with them.

Goodman cited a federal court filing in December as well as a recent press release about Drillman from the Department of Justice that named Riverside and Madison.

The release detailed a sweeping fraud scheme by the real estate investor in which he bought properties, then used bogus documents to show he paid more than the actual price. With those documents, he allegedly obtained larger loans from lenders than they would have otherwise made.

The Department of Justice said Riverside and Madison handled two of Drillman’s fraudulent closings. Neither title insurer was charged.

“Madison Title has not been accused of any wrongdoing, and we are proud of our record of trustworthiness and integrity,” a spokesperson for Madison said in a statement. “We remain steadfast in our commitment to transparency, telling our story, and addressing any concerns.”

Riverside Abstract, which reached a tentative deal to sell itself to health care entrepreneur Avery Eisenreich, did not return requests for comment.

Madison and Riverside are major players in the tri-state area. Both cracked the top 10 in The Real Deal’s 2018 list of the largest title insurers.

Fannie and Freddie are quasi-private entities that buy multifamily and residential loans from lenders. That gives lenders the capacity to issue new loans, providing liquidity to the mortgage market. The agencies function as a government backstop for a huge portion of U.S. mortgages.

For title insurers, acceptance by Fannie and Freddie is crucial because many mortgages are only granted if the loans can be sold to one of the entities.

Fannie Mae has guaranteed about 21 percent of multifamily outstanding mortgage debt in recent years. Fannie and Freddie support about 70 percent of the residential mortgage market. The entities purchase, guarantee and securitize conforming but not jumbo mortgages.

It is not clear how long the edict in Goodman’s memo will remain in effect, but the consequences for Riverside and Madison could be dire. Any multifamily or residential lender planning to sell a loan to Fannie would likely require the borrower to use another title insurer.

Riverside and Madison could shift their focus to large commercial mortgages or high-end residential loans, which are not backstopped by Fannie and Freddie.

Title insurance is an opaque but lucrative niche in real estate. It is supposed to prevent fraud and ensure buyers receive a clean and proper title to the property.

News about Riverside and Madison’s troubles started to appear a few weeks ago. A lawyer from Troutman Pepper sent an email to a client stating that some servicers and lenders were backing away from doing business with the two companies.

When the email leaked out, Troutman Pepper attempted to walk it back. In a statement, the firm apologized, endorsed the companies, and said the email contained “inaccurate statements” that were not approved by the firm. But Troutman did not specify which statements were incorrect.

“Troutman Pepper attorneys have worked with Madison Title and Riverside for many years in hundreds of loans; their services are professional and high quality, and we look forward to continuing to work together for many years to come,” the firm said.

Around the same time, Riverside Abstract emailed employees about its sudden sale, blaming the lawyer’s statement that it was barred from serving as a title and escrow agent for Fannie and Freddie loans.

“That statement was entirely false and it has since been retracted and an apology has been issued,” the company wrote. “But the inaccurate statement caused harm to our business and reputation.”

Meanwhile, Madison Title, through a public relations firm, asked The Real Deal to include Troutman’s reference to “inaccurate statements” in its coverage of the letter. The public relations firm said Madison Title felt that “updating the story with this language below would help clarify that the earlier published statements were in fact inaccurate.”

Goodman’s memo may explain why the law firm did not spell out exactly what was untrue in its lawyer’s leaked email.