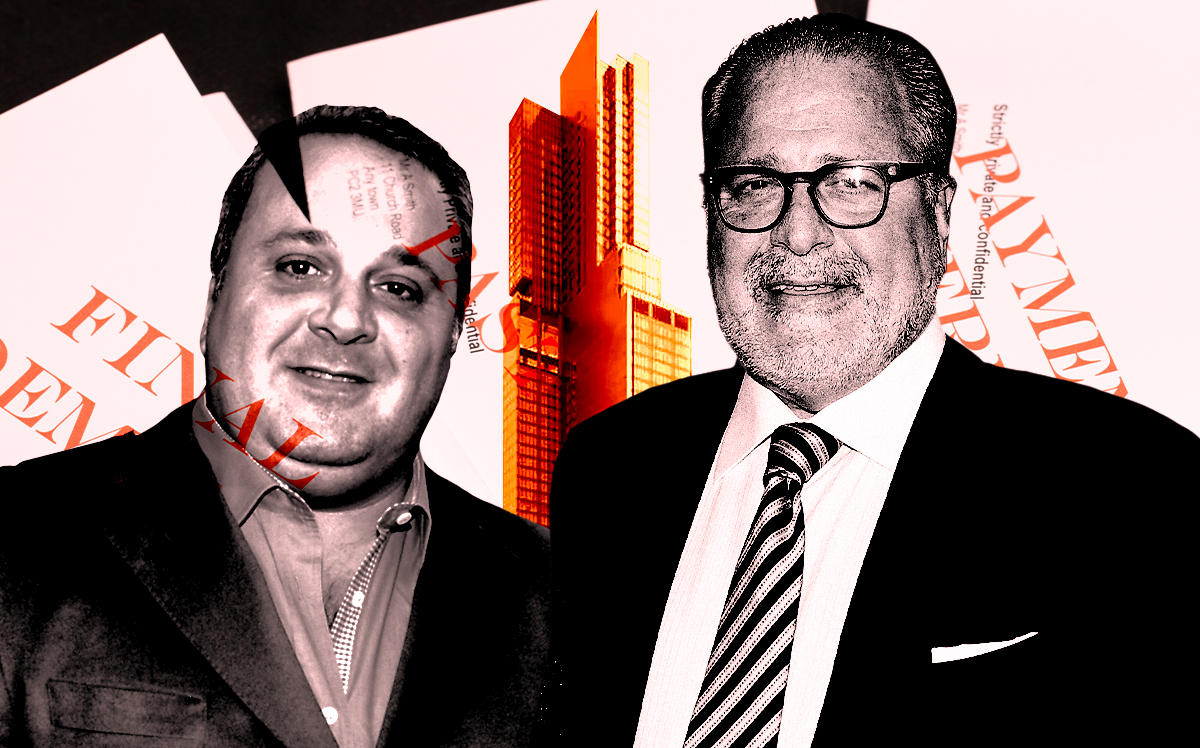

Mack Real Estate Group took control of a Hudson Yards development site long tied up in litigation with the Chetrit Group.

Mack closed on a $94 million title transfer for a vacant parcel at 545 West 37th Street, PincusCo reported. Mack acquired the site from a Chetrit affiliate in a deal that closed Dec. 18 and was recorded Jan. 2.

The transaction values the site at about $543 per buildable square foot, based on 172,00 square feet of unused development rights and no existing built space.

Mack and Chetrit did not immediately respond to requests for comment from The Real Deal.

The transaction caps a years-long unraveling of Chetrit’s plans for the site, which sits just west of Hudson Yards proper. Chetrit bought the parcel in 2012 for $26.5 million and later filed plans for a 131-unit, 373,000-square-foot hotel, a project permitted in late 2021. But construction never moved forward and there have been no permit filings since 2022.

Instead, the property became the subject of courtroom drama.

Three years ago, Chetrit defaulted on an $85 million loan tied to the property. The debt — a $53.7 million senior loan and $31.3 million mezzanine loan — was issued in 2018 by JPMorgan Chase and Mack, the latter of which became the sole owner of the debt, collateralized by the full equity interest in the site.

Mack won a judgment tied to an $18.5 million loan connected to the site last year. The firm also pursued a carry guarantee suit — related to guarantors’ funding shortfalls — that remains technically active, though court records show no filings since October.

In the summer, two lenders, including Mack, argued that Meyer Chetrit’s maneuvers around a $21.7 million debt to his late brother Jacob’s estate were an attempt to hide assets from creditors.

Mack and Maverick Financial are trying to recover $220 million and $132 million, respectively, from Meyer.

Back to the site itself, the 17,000-square-foot lot is zoned for commercial or residential development with inclusionary housing. City records pegged its market value at $14.6 million in 2022.

For Mack, the takeover adds another development opportunity to a portfolio skewed towards hospitality. Roughly a quarter of the firm’s New York City square footage is in hotels, according to PincusCo.

For Chetrit, the transfer trims a portfolio that still spans nearly 40 city properties with more than $1.6 billion in debt. The firm has not bought any New York City assets in the past two years, per PincusCo.

— Holden Walter-Warner

Read more

Chetrit defaults on $85M Hudson Yards loan

Chetrit lands $85M loan for Hudson Yards mixed-use project

Lenders claim Meyer Chetrit’s debt to brother’s estate “reeks of fraud”