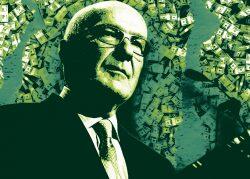

Office landlord Paramount Group is under fire after disclosing payments to its chief executive officer over the last three years that were not previously reported.

The company paid CEO Albert Behler at least $4 million for personal expenses and business interests, the Wall Street Journal reported citing recent security filings. The company disclosed the payments for the first time in a proxy statement last week. It follows a filing from February that also disclosed previously unreported payments to companies in which Behler and his wife have personal stakes.

In the past three years, the company has paid more than $900,000 for Behler’s personal accounting services. Paramount also paid more than $3 million to a jet-chartering company co-owned by Behler, $214,000 to a consultant who used Behler’s wife’s design firm and $220,000 for another use of the same design firm.

Public companies are typically required to annually disclose transactions above $120,000 involving people or entities related to the company. It’s unclear if the Securities and Exchange Commission is investigating the company’s dealings.

“Paramount Group regularly updates its disclosures as part of its commitment to transparency and in response to shareholder feedback,” the landlord said in a statement.

Additionally, the company paid $12,000 for wine from Behler’s vineyard in Germany and $77,000 above a company limit for Behler’s club memberships. His annual compensation in 2022 and 2023 was hundreds of thousands of dollars more than Paramount previously reported, which the company attributed to a “reclassification of certain payments.”

Paramount, which owns 14 million square feet centered around New York City and San Francisco, has been under fire from company shareholders.

Top Paramount executives earn disproportionately high pay packages related to returns and relative to other companies, according to a recent Green Street report, which called Paramount “one of the worst performing office REITs over many time periods.” Its stock price has dropped more than 60 percent in the last four years.

In the last five years, the company has also rejected two takeover offers without strategic reviews or explanations to shareholders, according to analysts.

— Holden Walter-Warner

Read more

Paramount signs law firm to 131K sf office space

Paramount Group CEO gets $12M for Upper East Side duplex

Paramount rejects all-cash takeover bid