As their proposed redesign of Hudson Yards West awaits a City Council vote, Related Companies, Oxford Properties Group and Wynn Resorts are trying to sweeten the pot.

The firms say they can build up to 4,000 residential units on the site, compared to the 1,500 apartments proposed as part of a broader $12 billion vision that includes a casino. The project is heading toward a critical City Council vote on proposed changes to the 2009 rezoning of the Western Rail Yard, which will determine whether it can compete for a casino license.

More housing could increase its odds of securing approval and, ultimately, winning a license. Of course, that remains to be seen.

The companies want to use surplus payments in lieu of taxes, or PILOTs, to pay for a $2 billion platform over the existing railyards and Long Island Rail Road improvements. Covering that cost, according to the companies, would make replacing a planned office building with two residential towers financially feasible.

PILOTs helped pay for the first phase of Hudson Yards. Under that arrangement, a nonprofit development entity created by the city issued bonds to pay for infrastructure upgrades and other upfront development costs. Instead of paying taxes, Related funneled portions of revenue from the commercial development to repay principal on the bonds.

Revenue from Hudson Yards has exceeded projections by more than $200 million per year, a figure that spurred Comptroller Brad Lander, a longtime skeptic of the arrangement, to admit his criticism of the financing model was misplaced. The surplus payments have gone into the city’s general fund. Since 2017, that excess revenue has totaled $860 million and is expected to reach $2.1 billion by fiscal year 2028.

Now Related wants to use the future surplus payments from the Western Yards — expected to eventually reach more than $80 million per year — to fund the platform. Doing so, however, requires a City Council resolution.

The announcement comes after the rezoning plan faced backlash from community members over the amount of proposed housing. Community Board 4 and Borough President Mark Levine both recommended disapproval of the plan, in part because it reduced the number of units from the 5,800 proposed in the 2009 rezoning.

Levine also agreed with Friends of the High Line, one of the casino’s most vocal opponents, that Related’s project needs to be “symbiotic” with the High Line, which could mean reducing the scale of the podium on “site C,” where Related plans to build a casino and 80-story hotel.

A representative for Community Board 4 declined to comment Friday. Levine’s office and a representative for Council member Erik Bottcher did not immediately respond.

Last year, Related filed its application to amend the 2009 plan, explaining that the development mix was no longer financially viable. The proposal included the same number of affordable housing units, but drastically cut the overall unit count, citing difficulty in marketing luxury condo units.

The rezoning changes are required for Related to compete for one of three available state casino licenses. Applications for the licenses are due in June and must go through a separate state process.

Related has said that the casino and the non-residential development make the project financially feasible. Other contenders have similarly dangled the prospect of not building anything on their sites if they are not granted one of the licenses.

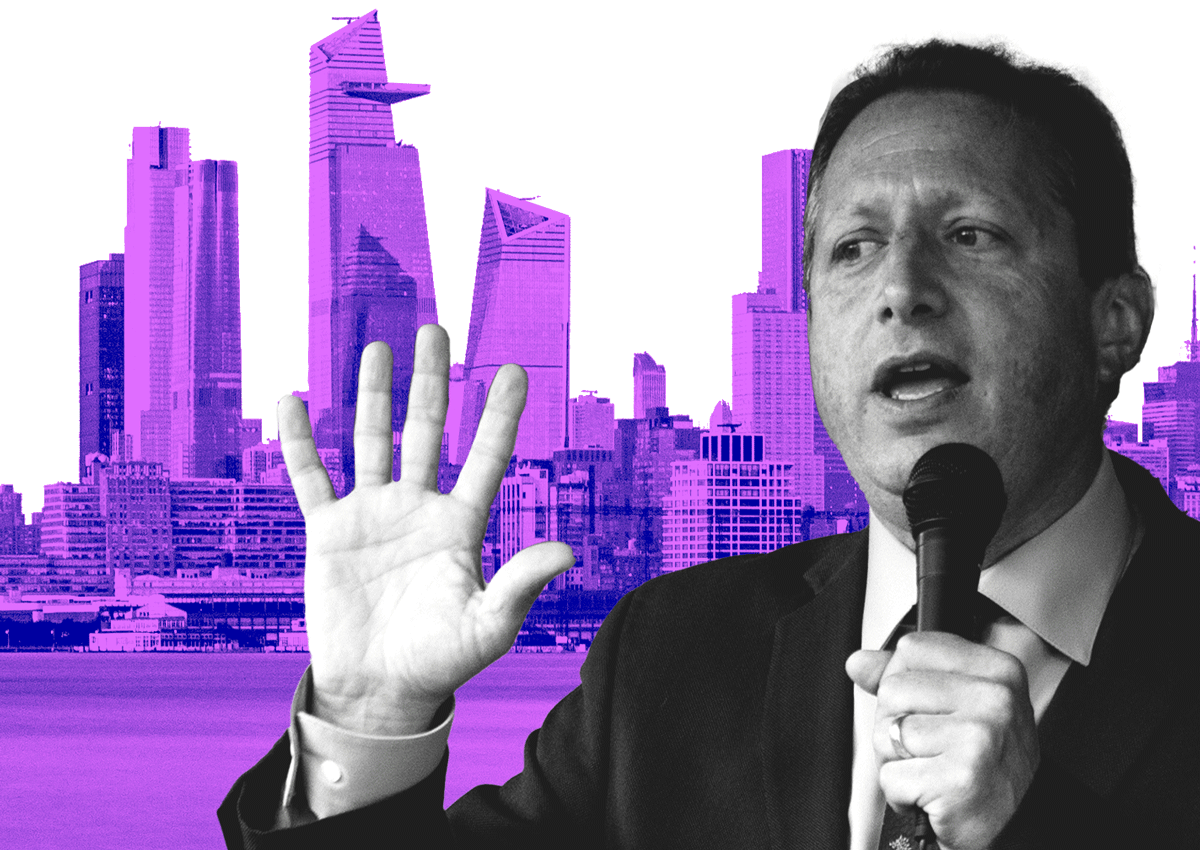

CEO Jeff Blau pointed to “consistent calls” for more housing as the inspiration for the new proposal.

“We tried to think outside the box and identified a historically successful funding model that would allow us to increase the amount of housing at the site to up to 4,000 units, while still preserving the other critical benefits of the project,” Blau said in a statement.

Read more

Lander candid on Hudson Yards: “I got it wrong”

The Daily Dirt: Manhattan BP rejects Related’s casino pitch

The Daily Dirt: Casino or bust?