Rialto Capital has found a new target in its aggressive pursuit to foreclose on borrowers of Signature Bank loans.

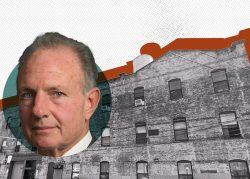

Rialto launched a foreclosure against Daryl Hagler’s Cigar Factory creative office building in Astoria. Rialto alleges Hagler defaulted on a $20 million loan in October 2024. According to the lawsuit, Hagler, a health care entrepreneur, guaranteed the loan.

PincusCo first reported the news.

In 2023, Rialto, along with Blackstone and Canada Pension Plan Investment Board, secured a 20 percent stake in a venture holding Signature’s $17 billion commercial real estate loan book. Rialto is tasked with servicing the debt.

Since then, Rialto has embarked on a relentless pursuit of initiating defaults on property owners who had secured loans from the customer-friendly Signature Bank. At least one borrower, Joseph Cayre of Midtown Equities, filed suit against Rialto alleging the firm is illegally manufacturing defaults. (That suit was quickly settled).

In one case, Rialto initiated a foreclosure on Watermark Capital’s 28-story, 497-unit residential project in Sunset Park last year. It was Hagler who stepped in as a lender and saved the project from foreclosure. Hagler provided a $42.5 million loan to Watermark, which replaced Rialto’s loan.

Hagler was proud enough of the deal to put out a press release about it.

“Mr. Daryl Hagler’s swift action in replacing the debt allowed the project to proceed without further disruption,” said the release.

Now, Hagler — a co-owner of Centers Health Care and a vice chairman of El Al Airlines — is a target of Rialto.

“We are committed to engaging with borrowers to find the best resolutions possible. At the same time, we expect these sophisticated, commercial borrowers to honor the commitments they made,” said a spokesperson from Rialto.

Hagler purchased the former DeNobili cigar factory at 35-11 9th Street for $26.4 million in 2022, marking a $5 million discount from what Bruce Brickman bought the 100,000-square-foot property in 2015.

Hagler is playing an increasingly active role in New York City real estate. He has backed Isaac Hager of Cornell Realty. The two partnered on a deal to acquire 960 Franklin Avenue in Crown Heights in Brooklyn for $42.8 million, which was sold in early 2024 for $64 million.

Hagler and his business partner, Kenneth Rozenberg, faced scrutiny from the New York Attorney General Letitia James for their oversight of nursing homes. The Attorney General sued the partners in 2023, alleging they used more than $83 million in Medicaid and Medicare funds to enrich themselves. Hagler and Rozenberg settled for $45 million, with money going to improve resident care at the nursing homes.

Hagler did not return a request to comment.

Read more

Joseph Cayre’s Midtown Equities files class action suit against Rialto over “sinister scheme”

Astoria cigar factory converted to offices highlighted NYC i-sales last week

Investor Daryl Hagler settles NY AG’s nursing home lawsuit for $45M