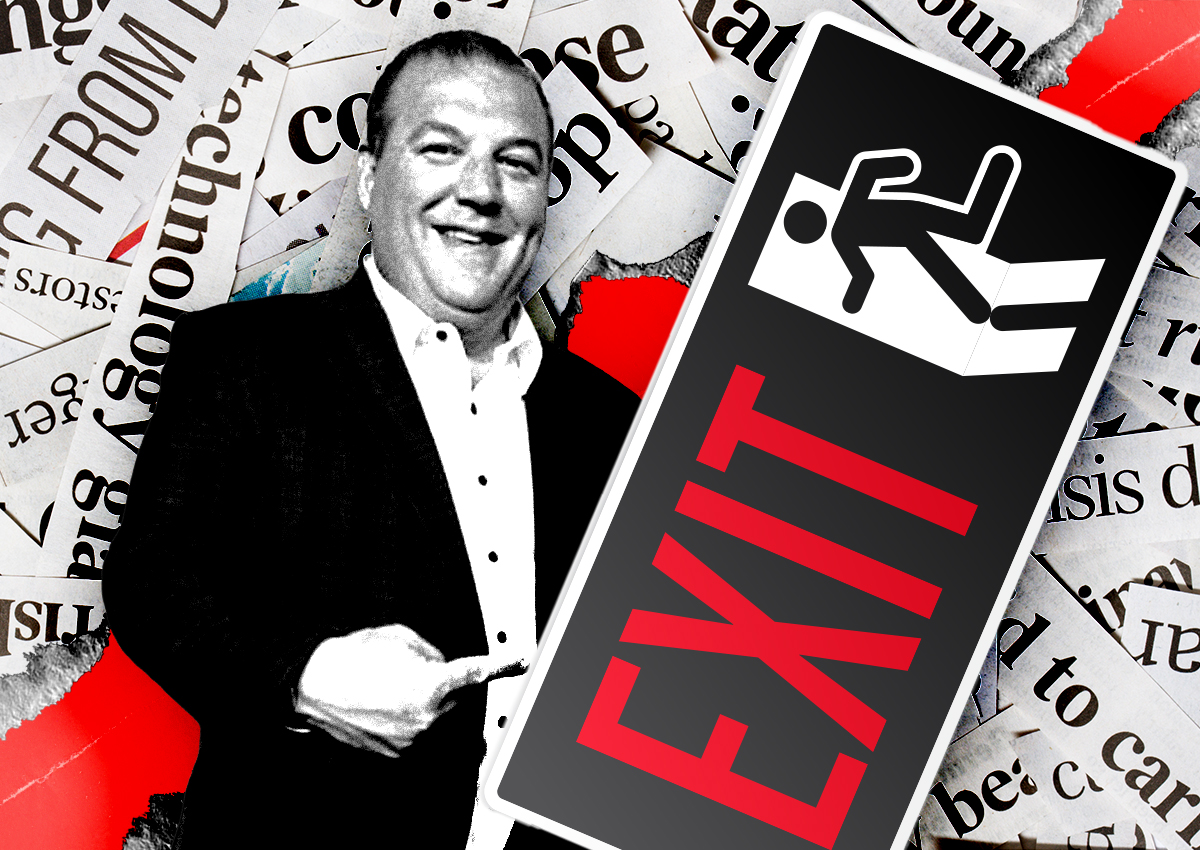

As Peapack Private Bank & Trust looks to capitalize on the lending void left by Signature Bank’s 2023 collapse, former Signature executive Joseph Fingerman told Commercial Observer he’s reflecting on a wild two years.

“It was never in our minds that we would fail,” Fingerman, who led Signature’s $33 billion commercial real estate loan book, said. “We were quite solvent when the FDIC seized us, so the thought of this happening was surreal. In our opinion, it was a definite overreach of [the FDIC’s] authority.”

The bank run began on March 9, 2023. Fingerman and his team spent the weekend preparing loans for Federal Reserve pledging before learning of the seizure while watching college basketball with his family.

“Texts and tweets can make a bank run a reality in minutes in this day and age,” Fingerman said. “In order to have a systemic failure you need two banks, and we had a somewhat similar business model to Silicon Valley Bank — so we were in the wrong place at the wrong time.”

Signature Bank collapsed three days later, on March 12, becoming the second-largest bank failure in U.S. history. The bank’s demise wasn’t rooted in its CRE portfolio but in its $16.52 billion in cryptocurrency exposure, which led to a deposit flight after Silicon Valley Bank’s historic failure.

Peapack CEO Douglas Kennedy saw potential in the chaos. “The opportunity when Signature and First Republic closed their doors was to run into New York City — not walk,” he said. The New Jersey-based bank recruited Fingerman.

In March, Peapack opened its Manhattan office at 300 Park Avenue with 6,000 square feet for private banking and 18,000 square feet of office space. Peapack’s loan book has grown to $6 billion, with roughly $2.5 billion earmarked in commercial real estate loans across the New York metro area and New Jersey.

The bank focuses on family offices that own about 10 properties and keeps most loans under $20 million. It targets multifamily, retail, industrial and mixed-use properties throughout the New York metro area.

Andrew Corrado, former head of commercial and private banking at Signature, is also part of the revamped Peapack. The duo joined Peapack along with 100 other employees from Signature and First Republic.

Fingerman briefly worked at A&E Real Estate Finance, where he helped to launch its financing platform.

— Holden Walter-Warner

Read more

Signature Bank layoffs hit key CRE team

A&E lending head departs after leadership shakeup

Signature Bank’s former head of CRE joins A&E Real Estate